CEO Foreword: Acceptance and change will drive recovery

When COVID-19 was officially declared a pandemic in March this year, most of the world was unprepared for the scale of its impact on society and the global economy. But slowly, the world is learning to respond to a new normal – a ‘new reality’. Global financial experts are optimistic that even this crisis can be overcome. And while there are undoubtedly tough times ahead, it is likely many industries will start to see some positive change in the year to come.

The pandemic affected automotive markets differently across the globe, but for some, the response was swift and effective. US markets have regained sales and service levels quickly, driven by its culture of optimism, adaptability and consumers’ high dependence on the automobile. And in China, where COVID-19 hit first, the market has also recovered well. Here, OEMs adapted fast, aided by their innovative, digitalized business models, and motivated by a younger, more tech-savvy generation of consumer.

Europe’s automotive industry has had to respond to a different set of challenges. When the pandemic hit, supply chains that rely on the single market were deeply affected by border closures, and some regions still face the prospect of a recovery in isolation. However, OEMs here are in a good position to reinvent themselves with digitalized sales platforms and smart, ecofriendly vehicles. They too – with the right strategies in place – can emerge from the crisis stronger than ever.

A dramatic shift in priorities

The pandemic has placed the industry’s shortcomings under a microscope. It has made manufacturers face their inadequacies and make difficult decisions about redefining their strategies and investing in potentially risky new business models. They now know that a return to their pre-COVID business structures may not be sustainable in future.

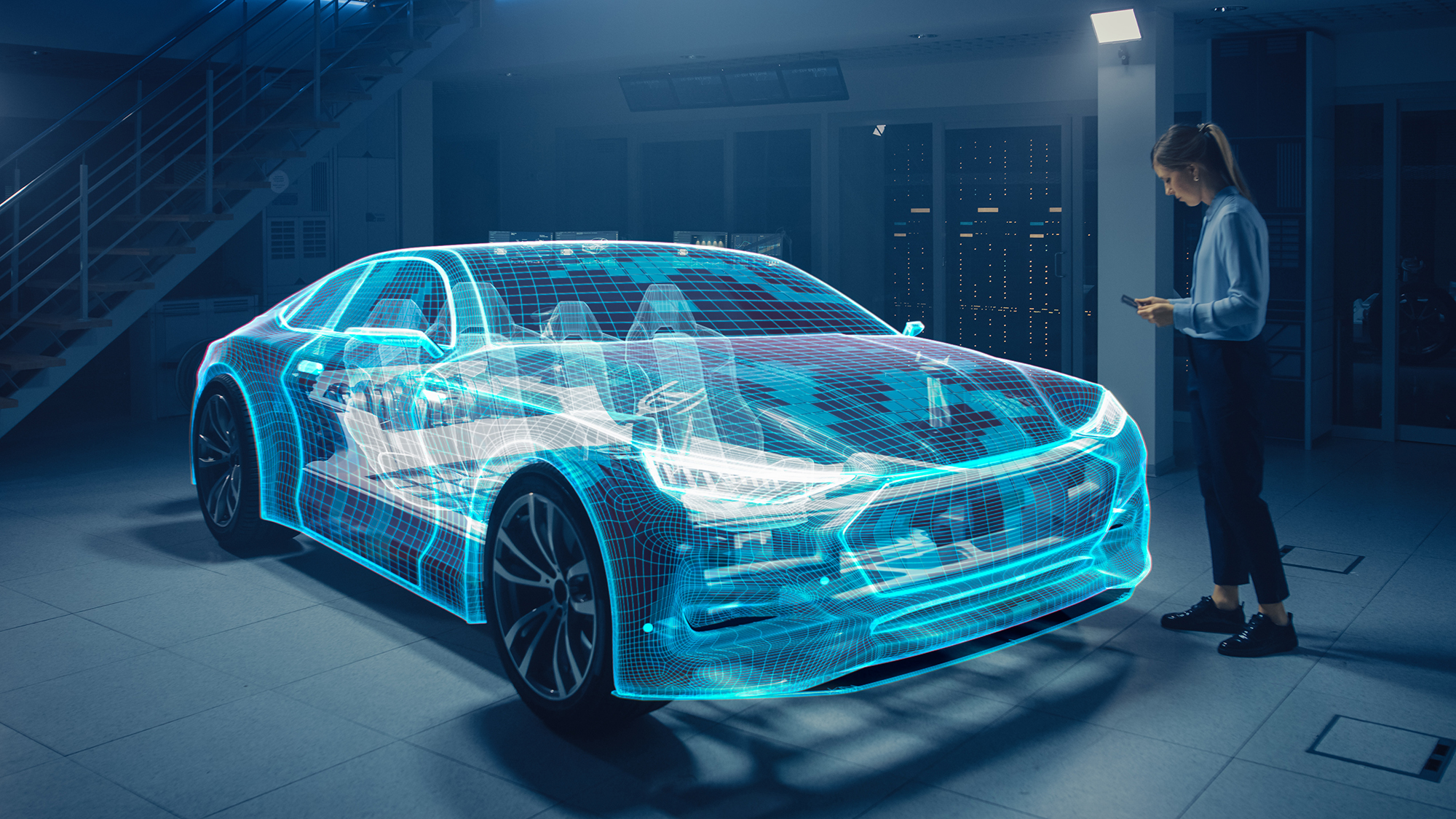

Automotive is not the worst hit industry but has still experienced the serious repercussions of consumer hesitation and nervousness about spending. Customers are looking to automotive businesses to make changes, not only to keep them safe, but also to ensure their investments in new vehicles and aftersales services are future-proof and worthwhile. Only now are OEMs realizing that the delivery of more innovative, digital products and services is as important to this industry as it is to others when inspiring customer loyalty. The most astute manufacturers have accelerated the development of trends such as digitalization across dealer networks, and are prioritizing online, direct-to-consumer sales to help them rebuild and generate new revenue streams while meeting the expectations of customers at home.

Some areas of the automotive industry have continued to grow despite the effects of the pandemic. In Europe, government incentives for consumers, business subsidies and looming emissions targets have driven an acceleration in the development of electric vehicles (EVs). Meanwhile, manufacturers in Europe and other parts of the world are keeping a close eye on the markets in China. This is not only because a large proportion of their manufacturing profits are generated in China, but also because EVs here cost less to buy, the infrastructure is stronger and its consumers were among the first to adopt cleaner and more connected cars.

A dramatic shift in priorities

The pandemic has placed the industry’s shortcomings under a microscope. It has made manufacturers face their inadequacies and make difficult decisions about redefining their strategies and investing in potentially risky new business models. They now know that a return to their pre-COVID business structures may not be sustainable in future.

Automotive is not the worst hit industry but has still experienced the serious repercussions of consumer hesitation and nervousness about spending. Customers are looking to automotive businesses to make changes, not only to keep them safe, but also to ensure their investments in new vehicles and aftersales services are future-proof and worthwhile. Only now are OEMs realizing that the delivery of more innovative, digital products and services is as important to this industry as it is to others when inspiring customer loyalty. The most astute manufacturers have accelerated the development of trends such as digitalization across dealer networks, and are prioritizing online, direct-to-consumer sales to help them rebuild and generate new revenue streams while meeting the expectations of customers at home.

Some areas of the automotive industry have continued to grow despite the effects of the pandemic. In Europe, government incentives for consumers, business subsidies and looming emissions targets have driven an acceleration in the development of electric vehicles (EVs). Meanwhile, manufacturers in Europe and other parts of the world are keeping a close eye on the markets in China. This is not only because a large proportion of their manufacturing profits are generated in China, but also because EVs here cost less to buy, the infrastructure is stronger and its consumers were among the first to adopt cleaner and more connected cars.

The new normal has meant finding new, flexible ways of operating. Some manufacturers will consolidate their businesses with other brands to share the investment in technologies and make research and development of new products and services faster and more agile. By dividing tasks with other brands, automotive businesses can become ‘super retailers’, focusing their time and investment on specific innovations or trends.

One of the biggest challenges for OEMs is that they are huge organizations, employing hundreds or thousands of people, many of whom have worked in the same way for half a century or more. However, manufacturers that can shake off decades of history and tradition will share some of the advantages enjoyed by brands such as Tesla, whose data visibility and clear, end-to-end business strategies were designed specifically to serve the needs of today’s consumers and those of the future. Brands that can digitalize their businesses fast and use data to meet customer expectations will be in the strongest position to overcome the crisis.

A new workplace culture

The urgency for cultural change is prompting manufacturers to examine new organizational structures. They must manage the effects of the transition from traditional to digital environments on their workforces, helping them navigate new approaches to work, training and interaction, especially now while so many people are working remotely. New recruits, for example, may need to learn their roles within the business without setting foot in an office environment or meeting a single colleague face to face.

When the pandemic hit, most businesses felt that home working was a temporary measure. However, some organizations are choosing to introduce more permanent structures that will support home working longer term or even permanently, relying on their human resources teams to take a leap into the unknown. Healthy home working models must still enable employees to feel part of a bigger team, and people functions are exploring ways of ensuring employees are happy, comfortable and engaged, while managing the detrimental effects of industry job losses and restructuring on wellbeing.

With automotive businesses leaning towards more digitalized structures, a shortage of talent with the right skills is also posing a challenge. OEMs must alleviate the shortfall by generating the right skills within their existing workforces, delivering specialized training to people in cost effective and convenient ways while keeping the business moving.

New models for the future

No-one knows when the pandemic will end, but even when it does, consumer behavior and expectations are unlikely to return to what they were before. Vehicle manufacturers must see the crisis as the catalyst for their transformation, not a temporary stumbling block to overcome before returning to their old ways. Businesses that don’t move fast enough to fill the gaps in the market will be quickly replaced by others who will.

Forward thinking organizations will take their experiences of 2020 and use them as opportunities for positive change that fit the digitalized future of manufacturing. Automotive suppliers like MSX International can guide them through their transformation, helping them to find their position in the market and implement strategies that help them prosper. Those willing to move quickly and adapt are the ones who will make it through.

I am proud to present the November issue of Benchmarker, in which we explore these topics and more, reflecting on the extraordinary challenges our industry has faced in 2020, those it has already overcome, and the promising and exciting future we can all look forward to.

About the Author:

Patrick Katenkamp

CEO, MSX International

With more than 20 years of experience in the automotive field, MSX International RNS, Chief Executive Officer, Patrick Katenkamp oversees the company’s business strategy, expansion and growth of the company globally.

Patrick is also a member of the company’s board of directors.

As an accomplished leader, Patrick has led the go-to-market and growth strategies for several large global technology and services companies.Before joining MSXI, Patrick served as President of Software International at Cox Automotive. Before Cox Automotive, Patrick served as the CEO at incadea, a global provider of Dealer Management Solutions. Additional leadership roles include Opel & Vauxhall in the area of Digital Marketing.

Whilst at Opel & Vauxhall in Germany he built a European team to consolidate CRM activities and worked with the Executive Opel Board to align the business’ strategy.

Prior to this, he spent seven years at General Motors Europe from 2003 to 2008, three years at Booz Allen & Hamilton from 2000 to 2003 as an automotive industry Management and Strategy Consultant, and five years at Electronic Data Systems (EDS) from 1995 to 2000 where he was responsible for the implementation of various large automotive IT projects.