Forging an electric future: How US dealerships are preparing for the challenges ahead

Dealerships in the US are facing extensive change as the growth of the electric vehicle (EV) market puts pressure on sales and service models. In this article, Shawn Coyle, Vice President and Global Account Executive, MSX, explores how automotive manufacturers and their retail networks can manage the necessary adjustments to their operations while upholding the traditional, community-led values of the true American dealership.

“At some point, the adoption of EVs will pass a tipping point at which adoption will accelerate in an exponential fashion, like the sudden explosion in smartphone take-up soon after the devices emerged onto the market.”

Please explain the scale of the dealer network in the United States and its importance to society.

The United States is one of the largest car-buying markets in the world, second only to China, with more than 14.5 million light vehicles sold in 2020 (LMC Automotive). Its dealer network is vitally important to the economy – a source of more than a million jobs, according to the NADA DATA report, and a major contributor of taxes. Despite a slowdown during COVID-19, it remains one of the country’s biggest revenue generators. In 2020, according to NADA, there were more than 16,600 light vehicle dealerships in the United States and the US Bureau of Economic Analysis lists the motor vehicle and parts dealer industry as being worth $327 billion per year.

The dealership network is also deeply rooted in the fabric of American society. Its support for local sports clubs and non-profit organizations is well known. And even during the pandemic, dealer teams were reported as lending their fleets, service centers and staff members to helping their communities overcome crises such as food delivery or PPE shortages.

In the US, franchise laws regulate and promote the buying and selling of vehicles through dealerships, which help maintain high levels of competition, and protect customers with high-quality products and secure financial arrangements. They ensure vehicle purchase transactions take place through the dealer in most instances, so OEMs still rely on their networks for vehicle sales and repair.

Value added by US retail trade of motor vehicle and parts dealers (billion US dollars)

Source: MSX Analysis, US Bureau of Economic Analysis

Value added by US retail trade of motor vehicle and parts dealers (billion US dollars)

Source: MSX Analysis, US Bureau of Economic Analysis

How do you think the adoption of EVs will change or affect dealer networks in the US?

The regulations that promote and protect dealerships are likely to remain in place regardless of powertrain, so manufacturers will continue to rely on dealers to sell, deliver, service and support EVs. But retailers are going to face many challenges as they move from the sale and service of internal combustion engine (ICE) vehicles to incorporate EVs and other engine types. Workshops will need to recruit technicians with relevant training. Plus, salespeople will have to adapt to the expectations of the consumer, who’ll demand a more comprehensive experience when buying an EV. Customers will need information on the latest grants and subsidies, battery range, charging times and infrastructure. And they’ll require details of the vehicle’s technology, maintenance requirements and how to receive over-the-air software updates.

With EVs comes a new set of requirements associated with equipment. The tools and machinery needed will depend on the specifications of the brand, but in general, dealers will have to install heavier lifts, for example, and new facilities to handle batteries safely.

How will dealerships support both ICE vehicles and EVs, and how will their offerings change?

To start, dealerships may create a separate process, dedicating an area of the workshop – one or two bays – to EVs, depending on the size of the dealer. Over time, the EV-related segment of the operation will increase in line with the growth of the industry and consumer demand.

Currently, parts sales and servicing of vehicles generates a large proportion of dealer revenues – NADA reports that in 2020, these dealership operations made more than $111 billion. As dealerships move towards the servicing of EVs, regular maintenance requirements, such as oil changes or spark plug replacements will decrease. Maintenance of this kind will be limited to items such as suspension parts and tire replacement or tire-life optimization. Dealers will need to replace that revenue by supporting the sale and management of new services and products. Connected services such as entertainment packages or insurance will be bundled and sold through the vehicle. And special deals or price reductions will be tailored to individuals based on their safe driving habits, captured by their vehicle’s connected features. In future, other revenue opportunities from EVs and plug-in hybrid vehicles may arise in the form of battery refurbishment or fast charging services.

How different do you think the US dealership model will look in the years to come?

Here, OEMs invest heavily in marketing and advertising, and in creating the best possible consumer experience. On all levels, it’s the dealer who manages the customer relationship and manufacturers can be certain that transactions are consistent and well managed. But the COVID-19 pandemic has highlighted the importance of a digital presence to dealers and changed the perception of the consumer, who knows that he or she can interact with the dealership without having to leave home. But the move to EVs means it’s going to be more of a challenge for them to strike the right balance between providing new sales and service models that meet customer needs, and ensuring that the true dealership experience remains.

People are becoming more comfortable with the concept of researching cars and buying them online. Customers are now demanding repair services at locations and times that are convenient for them. And as EVs become more popular, the online element of the process takes on a bigger role within the sales and service journey. These digitalized offerings will complement traditional business models and create a need for new dealer services, such as home deliveries for purchases or test drives, and mobile repairs on customers’ driveways or at their place of work.

What’s the status of the charging infrastructure in the US, and how is this having an impact on EV adoption?

EV adoption is hindered by the fact that there aren’t enough charging stations to counteract range anxiety in consumers. And those that are available are often in use – so for the driver in a hurry, it’s not practical. The charging infrastructure still has some way to go before it supports a significant adoption of EVs in the community and OEMs are forming partnerships with utility companies to install chargers in homes where possible. At some point, the adoption of EVs will pass a tipping point at which adoption will accelerate in an exponential fashion, like the sudden explosion in smartphone take-up soon after the devices emerged onto the market. By then, infrastructure will have to be available to support it.

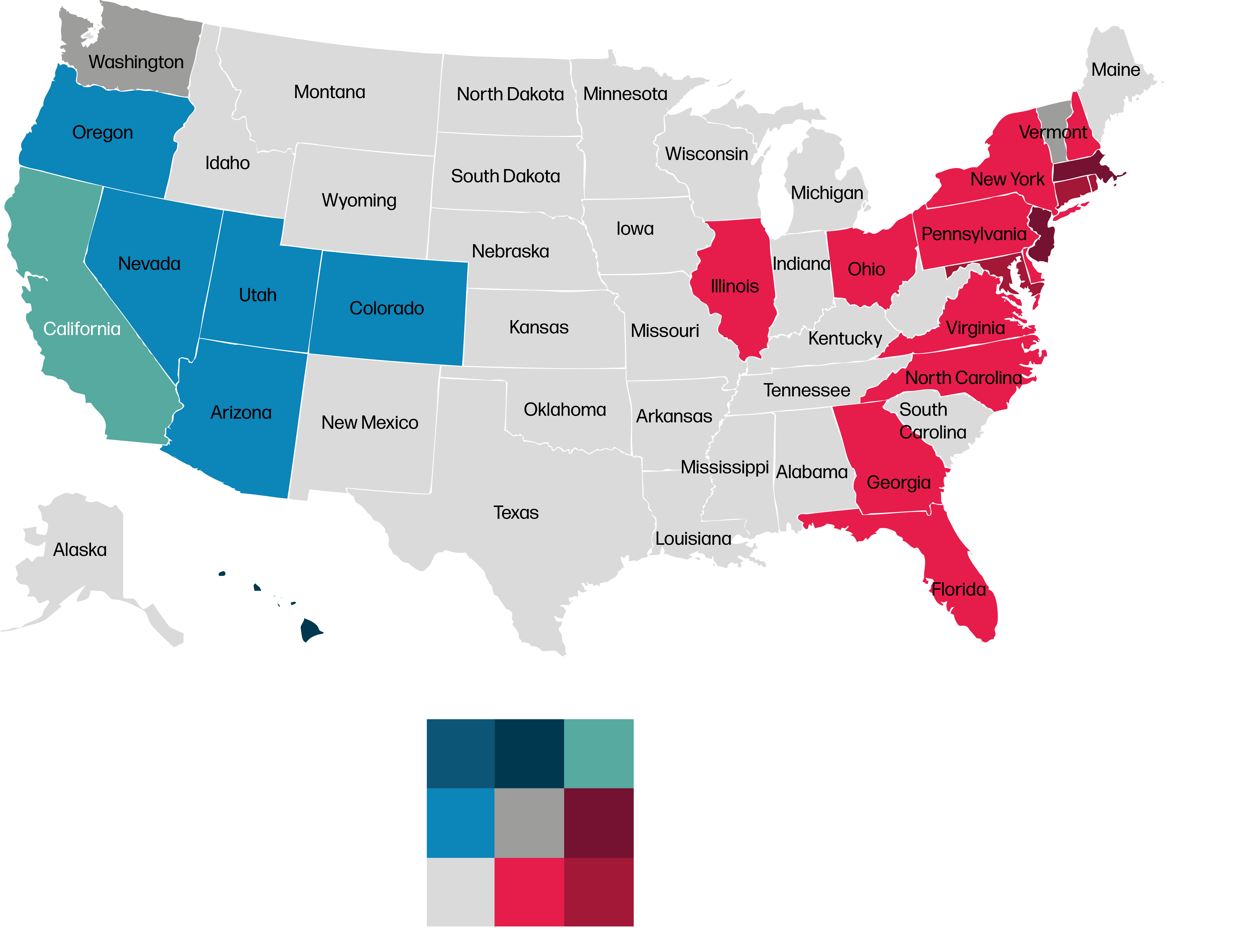

US states by BEV penetration and infrastructure maturity

This graph displays the all-electric vehicle penetration and charging infrastructure maturity by US state.

MSX data analysis shows that California demonstrates both strong EV adoption and charging infrastructure maturity compared to the rest of the US. Other west coast states tend to have relatively good EV adoption rates and low charging infrastructure maturity, versus stronger infrastructure and lower EV adoption on the east coast. Generally, compared to other states, central states show both low EV infrastructure and low EV adoption.

The estimated electric vehicle penetration is calculated using the total number of all-electric, light-duty vehicles registered in each state at the end of 2020, divided by the total number of light-duty vehicles registered in 2019. The charging infrastructure maturity is based on the number of publicly accessible electric vehicle charging stations per square mile of land area in each state.

Source: MSX Analysis, Data Sources: US Census Bureau, US Department of Energy Alternative Fuels Data Center, US Department of Transportation Federal Highway Administration

US states by BEV penetration and infrastructure maturity

This graph displays the all-electric vehicle penetration and charging infrastructure maturity by US state.

MSX data analysis shows that California demonstrates both strong EV adoption and charging infrastructure maturity compared to the rest of the US. Other west coast states tend to have relatively good EV adoption rates and low charging infrastructure maturity, versus stronger infrastructure and lower EV adoption on the east coast. Generally, compared to other states, central states show both low EV infrastructure and low EV adoption.

The estimated electric vehicle penetration is calculated using the total number of all-electric, light-duty vehicles registered in each state at the end of 2020, divided by the total number of light-duty vehicles registered in 2019. The charging infrastructure maturity is based on the number of publicly accessible electric vehicle charging stations per square mile of land area in each state.

Source: MSX Analysis, Data Sources: US Census Bureau, US Department of Energy Alternative Fuels Data Center, US Department of Transportation Federal Highway Administration

What sort of incentives are being offered to encourage EV adoption in the US?

The purchase price of EVs has, until recently, been a barrier to consumers. Brands such as Tesla have marketed their products at prices that are beyond the financial reach of most consumers. But this situation is beginning to improve with greater competition and the launch of new models by OEMs. Now that EVs are more accessible, take-up will begin to increase.

Government purchase incentives are also improving. Some customers qualify for federal tax credits of up to $7,500. And drivers can also benefit from practical advantages which vary from state to state, such as the use of special vehicle lanes, cheaper registration fees and free parking. This favorable environment for EV drivers will see a gradual phase out of ICE sales in some states according to McKinsey & Company, whose recent report on EVs predicts that by 2030, EV and hybrid sales will make up about 53% of all light vehicle sales.

How can OEMs manage the transition across their dealer networks fast enough to meet changing needs?

OEMs are working hard to provide training and ensure their networks can manage large elements of the transition themselves. They have competent sales and service groups, but managing a transition of this scale using internal resources is a huge challenge. Some manufacturers are employing the help of third-party organizations, such as MSX, to help define processes, implement new business models, and provide the skills, tools, and technologies dealers need for a smooth transition.

Factors such as low fuel costs and long driving distances in the US have made it difficult to predict consumers’ enthusiasm for EV adoption. However, interest is growing and this, alongside environmental incentives, is helping inspire an extraordinary commitment from manufacturers to produce affordable, high-quality EVs for their customers.

About the Author:

Shawn Coyle

Vice President and Global Account Executive

Shawn joined MSX in December 2013 and is currently responsible for driving a global account strategy for MSX’s largest customers and for developing and leading the Americas sales team to drive sales penetration and new business. Prior to joining MSX, Shawn served as the Senior Vice President of Manufacturer Relations at Penske Automotive Group (PAG) for five years as well as for Ford Motor Company, where he worked with the company’s dealer network before moving into field strategy. Shawn can be reached at scoyle@msxi.com.