New capabilities for tomorrow’s retail models:

How OEMs, retail partners and customers can win together

by Jayesh Jagasia, Global Solution Leader, Sales Performance Business Value Stream

The franchised dealer model has long been hailed as the dominant automotive distribution model. Its success is testament to the agility, adaptability and entrepreneurial spirit of the dealer network who have powered the growth of the industry. However, the rise in new technologies and the emergence of new industry players will see the automotive retail sector undergo profound change at a pace and scale not witnessed in a hundred years.

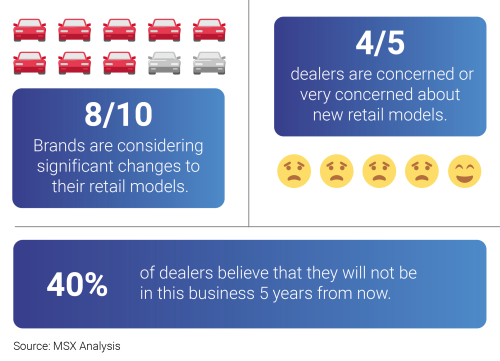

According to MSX research, a majority of the top 10 global automotive OEMs are exploring different distribution models, distinct from the tried-and-tested franchised dealer model. Some have already introduced new models, while others are still planning their transformation, and some have communicated their intent. Regardless of where individual brands might be on their distribution and retail transformation journey, it is abundantly clear that the future of automotive distribution and retail is likely to look very different in the near future.

But, with change comes uncertainty, leading to concerns about the future of the franchised dealer network. Surveys indicate that around 80% of dealers are worried or extremely worried about the impact of new retail models. Moreover, 4 in 5 dealers expect to be operating a very different business in five years’ time. And while this transformation will see significant change for many traditional dealers, it will also create opportunities for new industry players.

As is true of any change, this transformation will also create new winners and losers.

The primary factors to retail success

MSX invests time in the boardrooms of some of the world’s leading automotive movers and makers. But we also dedicate our time to dealers, their staff and their customers. This gives us a unique insight and holistic overview of market trends and board-level decisions. Our analysis reveals three primary factors compelling automotive OEMs to begin exploring new distribution and retail models, including the agency model.

Firstly, OEMs have had to make generational investments in a host of new technologies – electric vehicles (EVs), connected vehicles, and advanced driver assistance and safety (ADAS) features. The regulatory environment makes this a tough business to succeed in. Manufacturers are exploring every avenue to enhance their profitability and strengthen their balance sheet. Industry groups estimate that distribution costs account for up to 30% of a new vehicle’s retail price, with half of that being spent on discounts and promotions. Distribution and retail are firmly on their radar to drive efficiencies and reduce structural distribution costs.

Secondly, over the last few years, several disruptors have entered the automotive market. Technology companies, venture capital-backed startups and well-funded Chinese brands all want a piece of the action. These companies are not burdened with the legacy of large dealer networks and are making brave bets on radically different purchase and ownership experiences. Traditional OEMs have no option but to compete, in part, by addressing their own customer experience challenges through new distribution models and retail concepts.

Lastly, data is fast becoming the new fuel of the automotive industry. This statement may be overused, but it continues to remain true. All types of data, from connected vehicle data to consumer behavior data, serve as the fundamental building blocks for analytics and intelligence. Securing access to huge quantities of high-quality data can determine whether a brand thrives or falls behind the competition. The need to access more, better-quality data throughout the purchase and ownership cycle requires OEMs to rethink their retail approach.

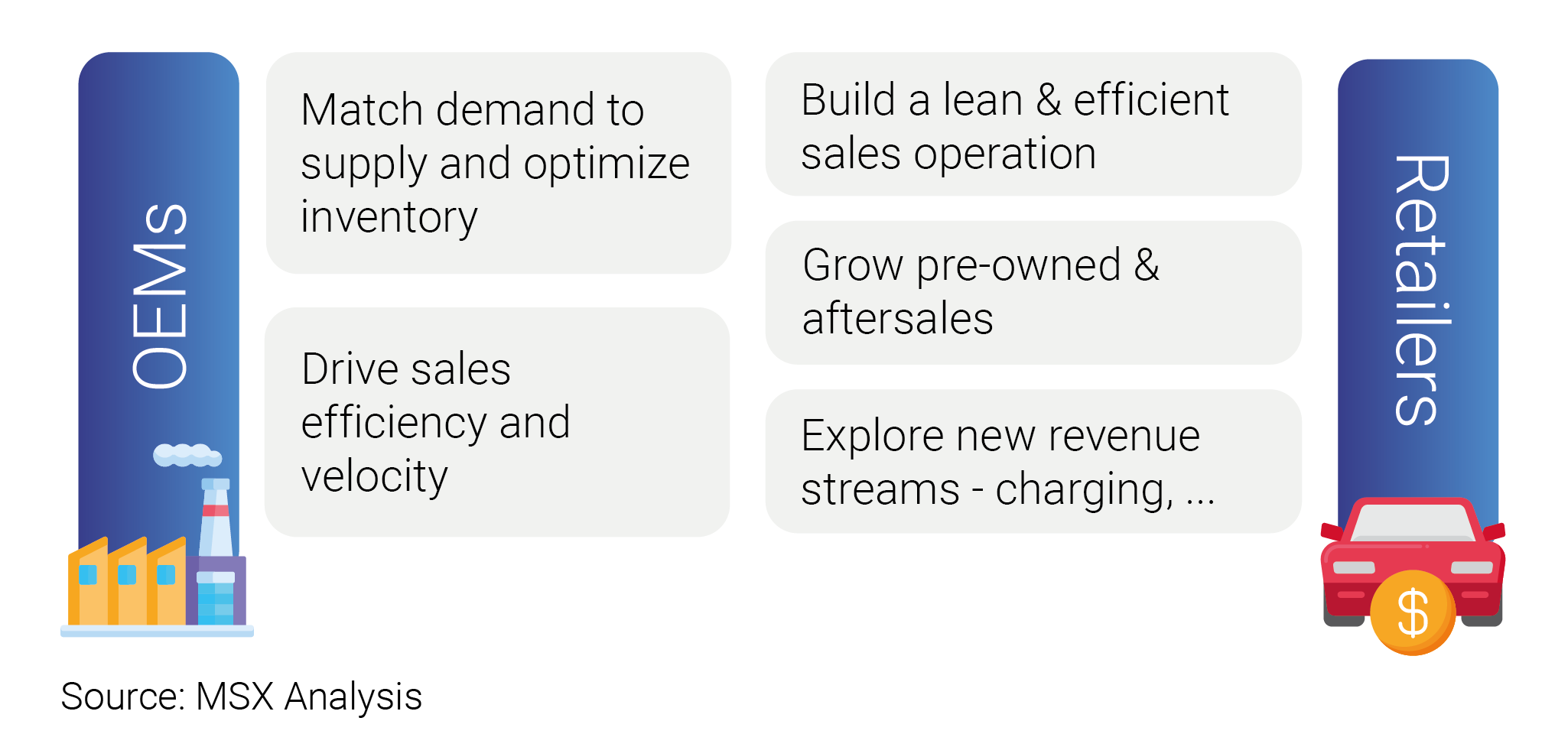

We have identified three priorities for OEMs and their retail partners to succeed together in this new era of distribution and retail. OEMs and dealers must both invest in new capabilities to support these priorities.

1. Reconfigure the business model

A shift to new retail models, such as the agency model, is more than just a distribution model change. It involves a transformation of the entire business model of the OEM, the dealer, or retailer across three dimensions – cultural, operational, and financial. Recognizing this and moving at pace to reconfigure business operations is key to success.

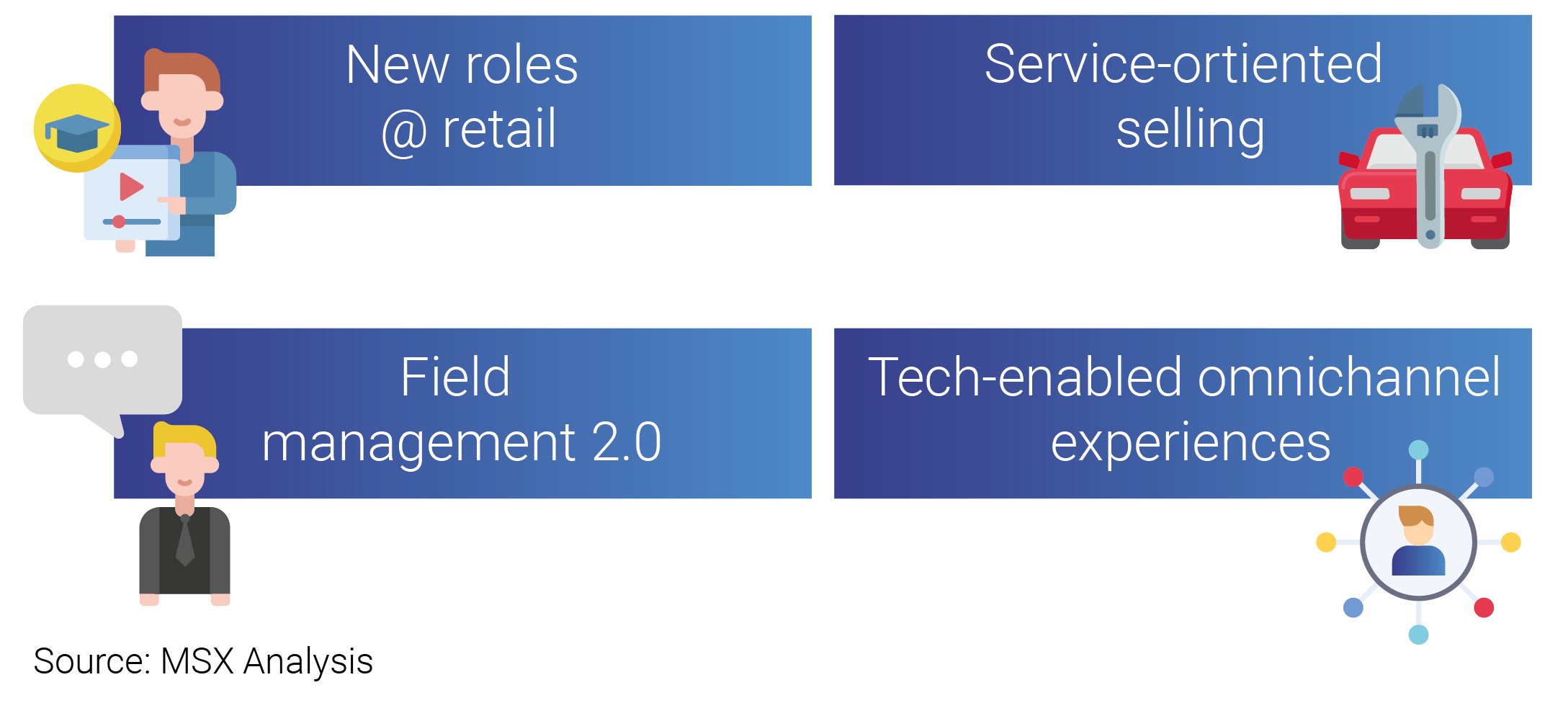

2. Reimagine the retail customer experience

The transformation of the distribution model and the emergence of new retail formats creates a huge opportunity to challenge established standards, and the reputation of poor customer experiences in our industry.

Customers’ expectations are ever-changing, driven by the speed, comfort and convenience offered by other retail fields. However, disruptor and challenger brands are pushing the boundaries of innovation, forcing OEMs and their retail partners to respond by reimagining their own brand and customer experiences.

3. Redesign the retail technology ecosystem

Disparte, disconnected software applications and technology platforms are the biggest barrier to delivering exceptional customer experiences and retail profitability in new retail environment. To succeed, it is essential that OEMs redesign their retail technology ecosystem and deliver a positive, seamless brand experience across multiple, connected platforms.

Consider the following insights to invest in strengthening your capabilities

Successful brands and retailers will invest time and energy to explore and experiment, while building new capabilities

Close collaboration is an absolute imperative. Success in this environment can only be achieved when OEMs and their retail partners work together. The nature of our business is such that OEMs and their retail partners are intricately linked, operating as each other’s extended enterprises. To succeed together, they must establish a transparent set of values, agree on common rules of engagement and find common ground. Through our years of experience, we understand that the most important factors when it comes to collaboration are fairness, trust, and a long-term investment in this transformation.

There is no doubt that a transition of this nature is a complex, time-consuming and resource-intensive task, fraught with challenges and risks. But, with the right framework for collaboration, and a long-term commitment from all stakeholders, we can ensure that the next hundred years of automotive retailing will be as successful as the last.