Selling e-mobility: How can retail networks prepare?

by Dirk Bott, Vice President, Global Sales Operation

The automotive industry has prepared for considerable change for some years, but 2020 marks the beginning of a new era. Stricter CO2 regulations mean manufacturers must adapt their sales and aftersales processes to meet electrical vehicle (EV) requirements and respond to the evolving expectations of business customers and consumers.

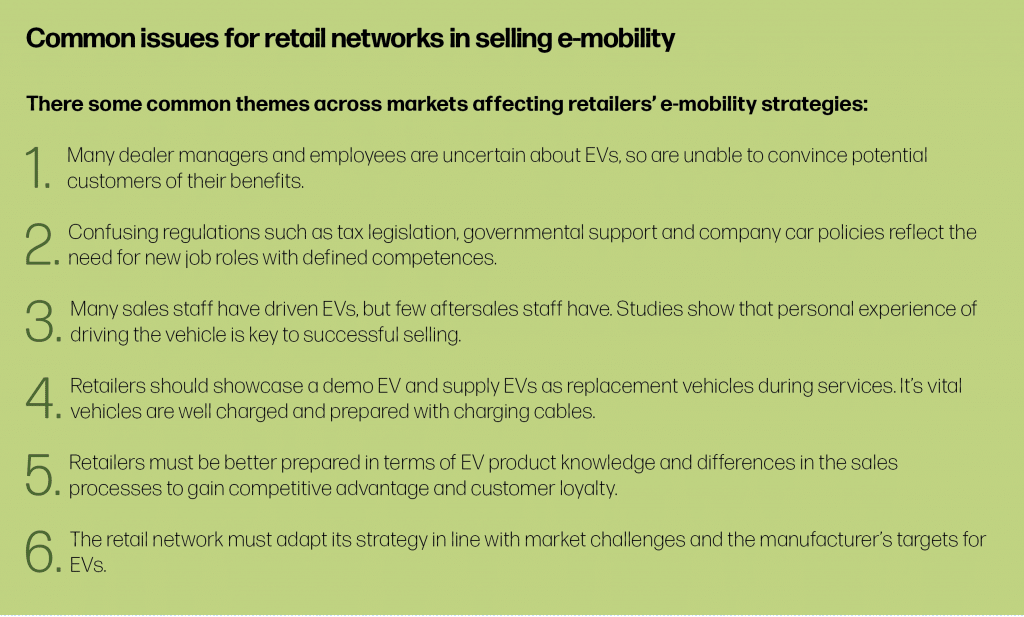

Information reported by the media, retail networks and dealers, reveals that subjective ideas and myths continue to surround EVs. These are affecting manufacturers’ responses and impeding the implementation of clear, coherent sales processes.

It’s imperative to understand the concerns of consumers which are rarely based on personal experience. Opinions vary from one market to the next, but in Germany, it’s thought that most consumers see EVs as too expensive, that they take too long to charge, their coverage is too small, and that the batteries pose a serious problem. If retail networks don’t address these likely doubts, EV sales will almost certainly suffer.

“A professional EV consultant will be a unique selling point for the retail network and the whole brand.”

– Dirk Bott, Vice President, Global Sales Operation

Refining processes to meet e-mobility needs

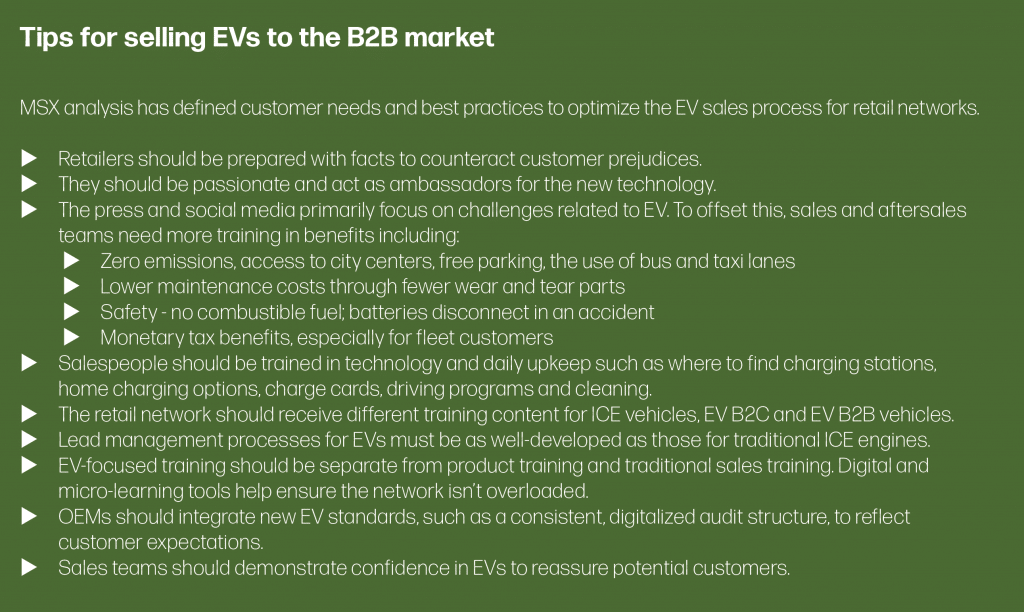

Sales processes for retailers in the e-mobility market vary considerably from those used in selling internal combustion engine (ICE) vehicles. To promote EVs, retailers need to know how to acquire more information from the customer in the early stages of a sale to ensure the purchase is a viable option for the customer. Questions should include; how far does the customer drive on a single journey, how far does the customer travel on holiday, and what charging options are available at home and at work?

Dealers must also be able to differentiate between types of e-mobility customers. Some consumers are innovators or ‘early adopters’ who have an affinity with technology and are less list-price sensitive and more total cost of ownership (TCO)-focused. They may already be on board with the notion of EVs and are therefore easier to sell to. Most consumers, however, are open to innovation but still need to be convinced of the logistics of EV ownership and costs. This group is the biggest challenge but also offers the largest sales opportunity for e-mobility retailers.

Selling e-mobility to fleets

A different ‘needs analysis’ study will help dealers to match the right e-mobility vehicle and package to the requirements and driving behaviors of prospective customers. For example, a fleet driver may become dissatisfied with a hybrid company car because fuel consumption can be higher than that of a standard ICE vehicle. It’s possible fleet drivers might also have false expectations of other benefits, such as tax relief. A welltrained e-mobility salesperson will be able to determine whether a plug-in hybrid electric vehicle or fully electric vehicle is most suitable for a fleet, based on its business model and daily demands.

Manufacturers must integrate important parameters into their EV sales processes and differentiate clearly between business-to-business (B2B) and business-toconsumer (B2C) operations. B2B customers, such as fleet owners, will ask for advice on how to determine the circumstances in which employees must pay for charging, and on other elements such as charge cards. Retailers must be able to calculate and present the total cost of ownership of the most suitable EV or hybrid vehicle, as well as explain the battery capacity, charging time and options, vehicle and battery warranty, range and general features of the vehicle such as torque, weather features and driving modes.

Creating the optimal sales environment

Showrooms will need to adapt, making the EV or hybrid center of attention. Demo vehicles, for example, are an essential tool for the showroom. But with this comes the need to adopt a crucial maintenance plan, such as to ensure the battery on the vehicle remains well charged so customers can test drive without risk of depletion. And the sales team should plan a pre-selected route that best reflects the vehicle’s features and capabilities, including at least one charging stop to demonstrate both AC and DC charging. It’s important to introduce customers to e-mobility experts in the workshop to provide information, not just on the finance and leasing, but also on the business economics of e-mobility vehicles and billing models that may be suitable.

EV retail strategies

Source: MSX research

For some time, many hardware stores have introduced customers to local trades experts to help them install their purchases. In the same way, some dealers are teaming up with trusted local electricians to support customers with the installation of wall boxes with the guarantee of a fair and honest service. This is also an opportunity for the dealer to generate additional revenue by selling the wall box and charging cables directly to the customer.

The emergence of EVs and hybrids will also affect used car sales processes. It’s even more important here to define exactly which vehicles the retailer should acquire, especially because the longevity of batteries varies significantly, and they can be very costly to replace. All stakeholders must also be clear on the retailer’s ownership structure, such as in the case of battery rental.

For now, sales of ICE vehicles will continue, so it’s important that retailers retain traditional sales skills. But with e-mobility moving swiftly into the marketplace, and with today’s customers already so well informed, it’s vital that new skills and processes are implemented quickly so the experience is seamless, and accurate information is readily available to the customer, regardless of their choice of vehicle.

About the Author:

Dirk Bott

Vice President, Global Sales Operation

Dirk joined MSX International in May 2012. He oversees global sales and contributes to the growth of large OEM key accounts such as BMW, Mercedes, VW Group, Geely Group and others. In his 20 years’ experience, prior to his engagement at MSX, he held different VP roles at European OEMs in sales, product, MI, training and strategy in regions that include China, USA, Europe or global.

He can be reached at dbott@msxi-euro.com